Customers prefer to buy from companies they trust. When consumers’ choices are limited and they have to do business with companies they don’t trust, customers only care about price or looking for ways to avoid to do business all together.

The television broadcasting companies are the best example of the latter. Most, if not all, research into sentiment of the industry’s customers, consistently shows their disdain with having to support these companies. There is a growing number of consumers who prefer to find ways of “cutting the cord” rather than buy from the companies they distrust.

The regulatory environment and capital requirements for potential direct competitors have left consumers as prey of established operators, who would rather spend money on lobbying government agencies than on finding ways to improve experience of their customers. On the surface, the growth of these corporate giants seems to challenge the argument “without trust, a business cannot grow”. However, if you look deeper into their corporate reports, you will notice that most of their growth comes from acquisitions and the “natural” subscription increases are heavily impacted by customer churn.

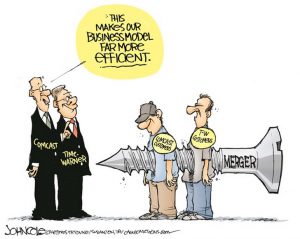

The acquisition game just encountered a very abrupt stop as unhappy customers have flooded FCC with a tsunami of petitions to kill the merger of Comcast and TWC. The too familiar tactics of divide and conquer (bribing so-called consumer activist groups with special dispensations in exchange for their public support) did not work this time. I predicted it might happen here over a year ago.

A company’s reason for existence is to serve its customers, to make their lives easier. Fulfilling this promise earns their profits honorably. The television broadcasting companies’ executives are aware that their customers hate their business practice of bundling channels and mysterious rate manipulations that come with this practice. However, they prefer to protect their undeserved profits by sharing them with regulators via political contributions and lobbying efforts. While they decided to take a defensive position against desires of their customers, the companies who choose to innovate content and distribution methods, will continue to gain momentum and keep taking a larger cut of the advertising budgets.

Another example of companies that seem to put their quarterly earnings ahead of their customers’ interests are software maker Intuit and tax preparer H&R Block. In fact they invest millions annually to lobby against any initiative promising to make the lives of their customers easier by simplifying the tax preparation.

On the opposite side of these digital “barricades” are companies like Uber and AirB&B mobilizing consumers, who experienced vast improvements over traditional transportation and hotel services, to put pressure on regulators that try to run interference for status quo.

Only time will tell if this is the beginning of a fundamental shift of power to the Social Consumer from “special” interest groups.

Leave a Reply